Some Known Questions About Thomas Insurance Advisors.

Table of ContentsWhat Does Thomas Insurance Advisors Mean?Top Guidelines Of Thomas Insurance AdvisorsThings about Thomas Insurance AdvisorsGet This Report on Thomas Insurance Advisors

Your healthiness is what permits you to work, make money, as well as appreciate life. What happens if you were to create a significant disease or have a mishap without being guaranteed? You could locate yourself not able to receive treatment, or forced to pay huge medical expenses. A study released in the American Journal of Public Wellness revealed virtually 67% of people really felt that their medical expenses belonged to the reason for their insolvency." Not having coverage can be monetarily ruining to families due to the fact that of the high expense of care." Health insurance bought with the Industry can also cover preventative services such as vaccinations, testings, and some appointments. In this way, you can maintain your health and wellness as well as health to fulfill life's needs. If you're independent or a consultant, you can deduct health insurance premiums you pay of pocket when you submit your income tax return.

5% of your modified gross revenue. Exactly how crucial is it truly? "The requirement for life insurance varies, and also it changes over time," described Stephen Caplan, CSLP, an economic advisor at Neponset Valley Financial Partners.

If you're married with a household when you pass away, what can life insurance policy do? If you're solitary, it could pay for burial expenses and also pay off any type of financial obligations you leave behind.

Unknown Facts About Thomas Insurance Advisors

Lots of professionals do not insure the possibility of a disability," claimed John Barnes, CFP and owner of My Household Life Insurance. The Social Safety Administration approximates that a special needs happens in one in 4 20-year-olds prior to they get to retired life age.

Still, Barnes advises that employee's comp "does not cover off-the-job injuries or diseases like cancer cells, diabetic issues, numerous sclerosis, and even COVID-19." The bright side is that special needs insurance coverage isn't likely to spend a lot; it can typically fit into many spending plans. "Generally, the costs of special needs insurance policy expense two cents for every buck you make," said Barnes.

The 2-Minute Rule for Thomas Insurance Advisors

If something takes place outside your house that you might be accountable for however that your home or vehicle insurance policy won't cover you for, an umbrella plan would fill that void - Commercial Insurance in Toccoa, GA (https://www.producthunt.com/@jstinsurance1).

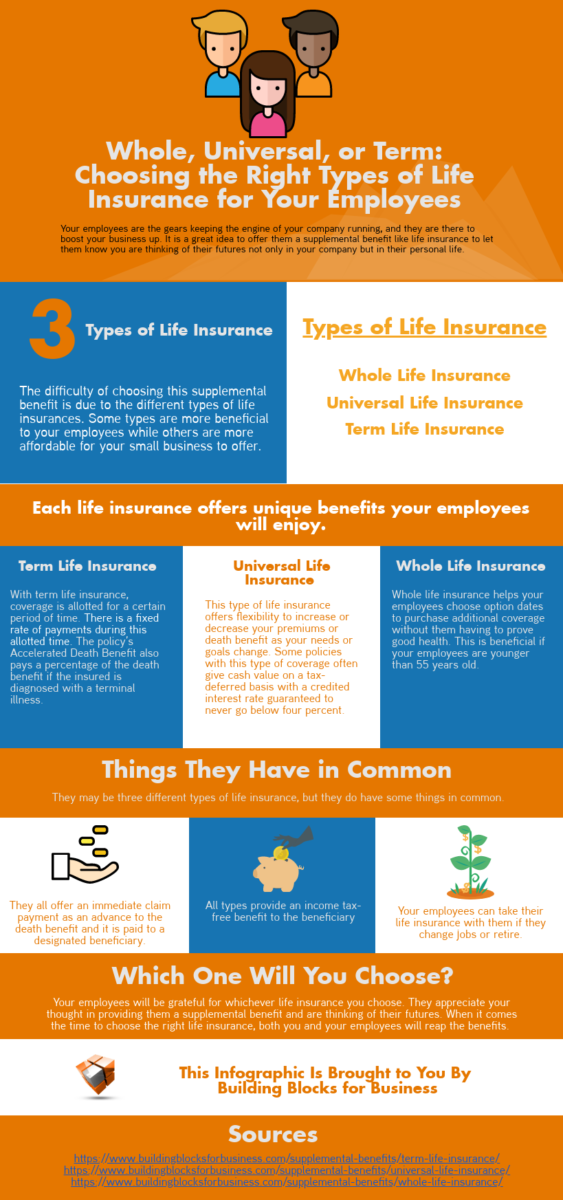

Whole life policies also reach a point where the policyholder can squander a part of the policy.

Things about Thomas Insurance Advisors

Period: 6 minutes Discover the various sorts of insurance policy to help you consider what you may and also may not require. Health insurance/Supplemental medical insurance HSAs/Health Cost savings Accounts Special needs insurance Life insurance policy Long-lasting care insurance policy Estate planning

Various sorts of plans assist you get as well as pay for care in a different way. A traditional kind of insurance policy in which the health insurance will certainly either pay find the medical company directly or compensate you after you have filed an insurance case for each and every covered medical expense. Insurance in Toccoa, GA. When you need clinical focus, you see the medical professional or health center of your option (https://www.twitch.tv/jstinsurance1/about).

An FFS option that enables you to see medical companies that minimize their charges to the strategy; you pay much less money out-of-pocket when you utilize a PPO provider. When you check out a PPO you generally won't have to file insurance claims or documentation. Going to a PPO medical facility does not assure PPO advantages for all services obtained within that healthcare facility.

Usually enrolling in a FFS plan does not ensure that a PPO will be available in your area. PPOs have a more powerful presence in some regions than others, and in areas where there are regional PPOs, the non-PPO advantage is the conventional benefit.